Western Europe Disposable Cutlery Market Poised for Sustainable Growth Through 2035 Amid Material Shift

Evolving foodservice trends, sustainability regulations, and innovation in biodegradable materials redefine Western Europe’s cutlery landscape

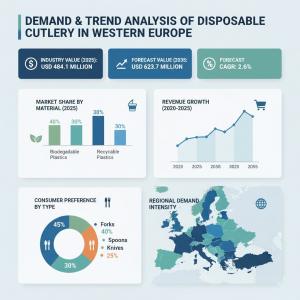

NEWARK, DE, UNITED STATES, October 24, 2025 /EINPresswire.com/ -- A new in-depth industry analysis shows that the disposable cutlery market in Western Europe is on track to expand steadily, with the valuation rising from USD 484.1 million in 2025 to USD 623.7 million by 2035, representing a CAGR of 2.6 % over the forecast period. Driven by evolving foodservice patterns, regulatory mandates on single-use plastics, and the emergence of biodegradable alternatives, this market presents notable opportunities for manufacturers, investors and strategic players positioning for the next decade.

Market Trends & Drivers

Several interlocking dynamics underpin the growth of the Western European disposable cutlery market:

• Foodservice and delivery growth: The proliferation of takeaway, on-the-go meals and online food-ordering platforms is increasing baseline consumption of single-use cutlery—from casual dining to institutional catering.

• Regulatory pressure: Countries such as the UK and Germany are advancing legislation and initiatives to reduce single-use plastic waste, pushing demand toward compostable and recyclable alternatives.

• Product innovation and material transition: While traditional plastic cutlery continues to fulfill cost and durability requirements, manufacturers increasingly adopt materials such as sugarcane bagasse, bamboo, and starch-based polymers. Sustainability, hygiene, and convenience are key differentiators.

• Segment leadership and stability: Analysis identifies the spoon segment as dominant (58.2% share in 2025) and thermoforming as the leading fabrication process (25.0% share), reinforcing structural stability even amid disruption.

• Country-specific momentum: In Germany, the market is expected to grow at a 2.7% CAGR, while in the UK, the forecast CAGR reaches 2.9%, reflecting stronger consumer sustainability awareness and regulatory momentum.

o Germany: driven by urbanised fast-food and deliver-in-place consumption patterns.

o UK: advanced legislation on single-use plastics and heightened preference for eco-friendly offerings.

Key Takeaways

• By 2035, the Western European market will reach approximately USD 623.7 million, translating into a total incremental opportunity of USD 139.6 million from the 2025 base.

• The dominant product segment—spoons—will remain central. With a 58.2% share in 2025, it underlines the priority for manufacturers to focus R&D and supply-chain optimisation around this product type.

• The wrapped-cutlery format (47.1% of the cutlery-type category) continues to gain traction owing to hygiene and convenience demands in sectors such as quick-service restaurants, hospitals, airlines and institutional catering.

Regional Outlook: Western Europe in Focus

Within Western Europe, country-level variation offers both strength and nuance:

• United Kingdom: With a projected 2.9% CAGR, this market is the fastest-growing in the region. Legislative momentum—such as bans on certain single-use plastics—coupled with high urban penetration of food delivery platforms, creates a fertile environment for advanced cutlery solutions.

• Germany: At a projected CAGR of 2.7%, Germany shows slightly lower growth but benefits from scale, strong foodservice infrastructure and high per-capita consumption of takeaway meals.

• Rest of Western Europe (Italy, France, Spain, Netherlands, etc.): While not all country-specific figures are publicly detailed, the report indicates rising momentum in these markets thanks to EU regulation, rising sustainability sentiment and increasing institutional catering demand across hospitality, healthcare and travel sectors.

• Segment concentration: The spoon segment (58.2% share) is especially strong across these countries, driven by take-away desserts, soups and single-serve hot/cold meal occasions. This reinforces a regional strategy: targeted investment in “go-to” formats such as spoons, wrapped offerings and hygienic packaging pays dividends.

Competitive Landscape

The regional competitive terrain is shaped by several strategic imperatives:

• Portfolio diversification: Key players are moving beyond inexpensive plastics to include wood, bamboo, bagasse and starch-based alternatives, enabling them to address the sustainability requirement without sacrificing functionality.

• Channel strategy: Direct sales to foodservice operators, institutional catering contracts and distribution via e-retail and retail chains are all relevant. The report highlights that sales channels including direct, distributors, e-retail and retail will be covered.

• Innovation in manufacture: Thermoforming remains the dominant fabrication route, as its flexibility enables manufacturers to easily integrate new materials, reduce wall thickness, and optimise cost. This gives an advantage to players investing in advanced production lines.

• Regulatory alignment & supply-chain resilience: With Europe’s sustainability agenda accelerating, companies that proactively adapt – by securing green-material feedstocks, ensuring traceability and implementing closed-loop programmes – will emerge as preferred suppliers for large foodservice and institutional buyers.

• Brand differentiation: Beyond function and cost, aesthetics, premium feel, branded packaging and consumer-facing sustainability messages are increasingly being deployed, especially in sectors like quick-service restaurants and travel catering.

Outlook & Strategic Imperatives

Given the moderate but consistent projected CAGR of 2.6% through 2035, the Western European disposable cutlery market is not explosive—but it is highly strategic. For industry participants and investors, several imperatives emerge:

1. Focus on value rather than volume: With relatively modest growth, profit margins will increasingly determine success. Premium sustainable materials, smarter packaging, and customisation for foodservice/ institutional channels are essential.

2. Targetged product investment: Prioritise the spoon segment (58.2% share) and wrapped cutlery formats (47.1% share in cutlery-type) where demand remains strongest.

3. Upgrade fabrication capabilities: Ensure thermoforming lines are adapted for new materials and lower-cost production to retain the cost advantage while meeting sustainability mandates.

4. Close regulatory-compliance gaps: With increasing EU and national mandates on single-use plastics, companies must anticipate downstream restrictions and retool their portfolios ahead of enforcement.

Get this Report at $5000 Only | Exclusive Discount Inside!

https://www.futuremarketinsights.com/reports/sample/rep-gb-18561

Checkout Now to Access Industry Insights:

https://www.futuremarketinsights.com/checkout/18561

Top Segments Studied in the Western Europe Disposable Cutlery Market

By Product Type:

• Spoon (Plastic, Wood)

• Fork (Plastic, Wood)

• Knife (Plastic, Wood)

By Fabrication Process:

• Thermoforming

• Die Cutting

• Injection Molding

By Cutlery Type:

• Wrapped Cutlery

• Dispensed Cutlery

By Sales Channel:

• Direct Sales

• Distributors

• E retail

• Retailers

By End Use:

• Food Service Outlets

• Institutional Food Services

• Household Use

By Country:

• The United Kingdom

• Germany

• Italy

• France

• Spain

• Netherlands

• Rest of Western Europe

Related Insights from Future Market Insights (FMI)

Reclosable Zipper Market: https://www.futuremarketinsights.com/reports/reclosable-zipper-market

Pallet Wrap Industry Analysis in Western Europe: https://www.futuremarketinsights.com/reports/pallet-wrap-industry-analysis-in-western-europe

Anti-Microbial Edible Packaging Market: https://www.futuremarketinsights.com/reports/anti-microbial-edible-packaging-market

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.